- K

- Dec 15, 2022

- 3 min read

Updated: Nov 17, 2025

"In the end, I am a teacher; that is really how I see myself." – Jorge Paulo Lemann

When we think about teaching, instructional delivery is the defacto thing that comes to mind. This is probably the most familiar setting in which a professor or a lecturer pulls up a set of powerpoint slides and speaks to the class.

Giving a two-day lecture on financial modelling has always been an enjoyable session for me - the interaction, debates and sharing of anecdotes. One of the biggest highlights personally is to see someone complete his/her Excel financial model (plugging the ending cash from the cash flow statement into the balance sheet) for the very first time.

Doing up a financial model might be considered rudimentary for seasoned bankers but a ginormous task for someone who is either not trained in corporate finance or struggling to put together an investment thesis at the workplace.

But my teaching engagements go beyond the classroom.

At the work place, I am also the go-to person when it comes to troubleshooting excel files and powerpoint, explaining a financial model to an analyst or investor, or when someone needs a slightly older person to be present in the room or to do the presentation in English, etc.

Aside from that, I've also been a listening ear to many of our colleagues at the office, from the senior and mid-level folks all the way to the rank and file. I've even been called to help in a situation whereby someone had called our front desk complaining about an imposter who offered him a job at our company.

In August, we closed a landmark financing transaction with a highly reputable investment firm.

The process was lengthy - mostly because we had very sucky lawyers - but also because it involved a deal structure that no one else had done before. Parts of the term sheet were tricky and the closing was even more convoluted.

One treasury analyst (协办) in my team had the 'privilege' of assisting me on the deal. Joke was that I had brought her aboard a pirate ship (带上贼船), unleashing an incredible amount of documentation in the process, spanning at least seven inter-connected agreements.

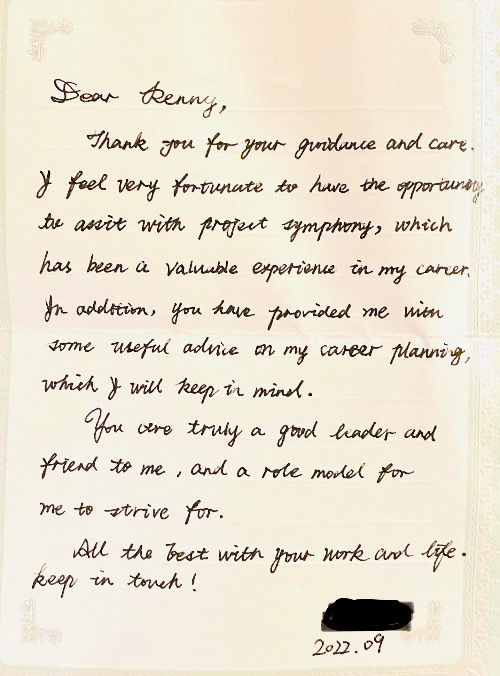

The deal was eventually closed and some weeks later, she resigned for better opportunities and left this note:

Over that same period (with a separate team), I was also running multiple conversations on getting our first-ever "ESG financing" framework accredited by a international ratings agency.

Although we had paid a fee for doing so, the negotiation process was tough. The ratings team sitting in Europe didn't have a clue on the overly long payment cycles experienced by public hospitals in China, and how supply chain financing for pharmaceutical companies delivering medical consumables actually resolves this critical financing bottleneck.

When we finally obtained the official second party opinion (SPO), I counted over 100 threads in the email exchange. It was not only the first time we had ever published a social and sustainability-linked financing framework and received a vote of confidence by an internationally reputed ESG ratings agency, but more importantly, this was one of the key CPs to drawing down on a RMB 500 million syndicated loan facility.

In situations like these, I find my teaching methods taking on a more practical element. I am no longer working within the 'harmless' confines of the classroom where I can freely talk about structuring, negotiation and valuation.

My actions have tangible repercussions on the outcome of the deal, and at every step, people are watching.

Middle-to-senior management roles (much like my typical classroom lectures on financial modelling) are often like stage performances: As long as you don't screw up big time, you can always afford a few slip ups, which is perfectly normal, but the show has to go on.

Look, most of the time, you work for money and are subject to the obnoxious KPIs placed on you because of your position.

But once in awhile, your job gives you a unique opportunity to make a difference.

That difference is sometimes not measured in the millions of dollars you bring in for the firm or the big bucks you bring home at the end of the year, but the impact that you make on the people around you.

That difference could range from anything as simple as fixing the alignment on a powerpoint slide, fixing a financial model, helping someone negotiate through a transaction bottleneck or simply changing the mindset and perspective of a particular person.

It is often said that we can't let our jobs define us. But how we do our jobs, and behave with our colleagues and clients ultimately determines the kind of person we are.